Die römische Bank während der Kaiserzeit von Italien - Moruzzi Numismatica - Münzen Medaillen und Banknoten

Hauptmenü:

Die römische Bank während der Kaiserzeit von Italien

On September the 20th 1870, the breach of Porta Pia determined the end of the temporal power of the Church. It's interesting to note that the first cannon shot - which opened the breach - was fired by a Jew, because of the anathemas launched by the Holy Father against who wanted to strike with arms the Eternal City. In the banking world, one of the most visible effects of this change was the closing of the Papal States Bank which, according to the Royal Decree of February the 2nd 1870, assumed the new name of Banca Romana. Rather than a closure, it was in effect a "change of ownership": the new Bank of Rome would absorb assets and liabilities and it would be located in the same office, retaining the previous privileges, including the authority to issue banknotes.

Also the capital, consisting of 10 million of lire, remained unchanged, as well as the amount of banknotes in circulation, which should not exceed three times the metallic reserve. Due to the installation of the National Bank of the Reign in Rome in a short period, the Bank of Rome accepted the sum of two million of lire as compensation to renounce to the exclusive right of issuing banknotes in the ex-Papal State territories. Beyond the intentions, at its birth the bank had to resolve soon adventurous operations, started by the past patronage management. For this reason, it wasn't easy to manage its running. Even after an initial attempt of correct administration, the opening credits without adequate guarantees increased, as well as bills of convenience, outstanding payments and other dangerous operations.

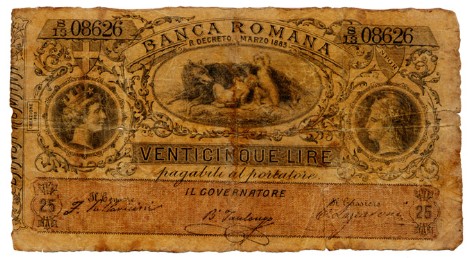

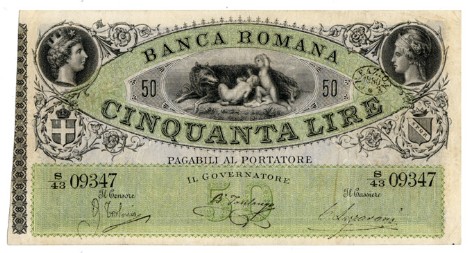

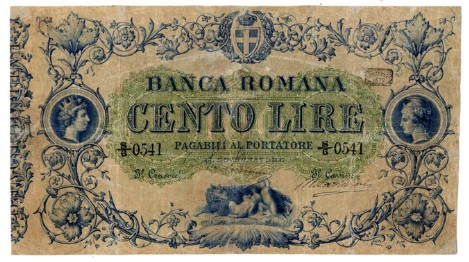

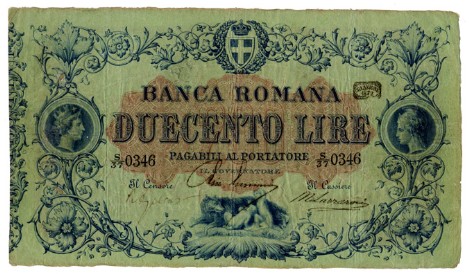

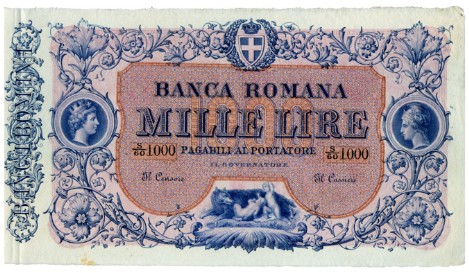

The first Governor of the Bank of Rome was Giuseppe Guerrini, who administered it in an upright manner, according to the statutory rules: he recorded a good start, leaving hope for a prosperous future, when it would be possible to delete the patronage favouritisms that burdened the previous Institute management. Because of the chronic shortage of small coins which, as we know, caused the well-known phenomenon of the illegal divisional circulation, with the Royal Decree of November the 6th 1872 the Bank of Rome was authorized to issue notes with value of 50 cents and of a lira. A few days later, the Royal Decree of November the 29th authorized the issue of new notes in the following terms: "Considering that the Council of Regency of the Bank of Rome decided to replace the old model notes with value of 1.000, 500, 200, 100, 50 and 20 lire, now in circulation, with other new model notes ..." with the values mentioned above.

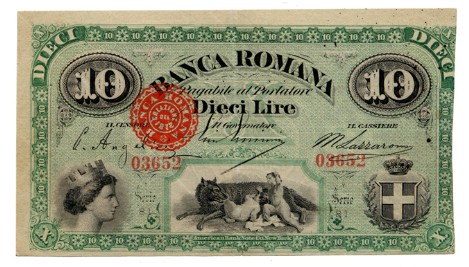

The following decree of December the 14th authorized the issue of 5 and 10 lire denominations, describing their features. We note that, unlike the other denominations, the 5 and 10 lire notes were created and printed by the American BankNote Co. of New York, that made also a test model of 2 lire note, which however remained in draft form as it was never issued. After the legislative disorder that characterized the first years of paper issues in the new Kingdom of Italy, on April the 30th 1874 was finally passed the first organic law related to the issuing banks. Among other things, it stipulated that the amount of their notes could not exceed three times the deposited capital or the net patrimony. After this provision, the Bank of Rome decided to proceed with the capital increase, that reached 15 million of lire.

After issuing the new law, the government verified the circulation of the six Institutes authorized and it established, with the decree of September the 23rd 1874, the total maximum issue limit both for all Institutes and for each bank. In relation with the recent increase of the social capital, for the Bank of Rome this limit amounted to 45 million of lire. The Governor Giuseppe Guerrini worked always observing this limit and, despite the pressures of associates and directors, tried to prevent that the bank management suffered heavy deficits during the difficult period of the international economic crisis that began in 1873 called "the great depression". Even if the failure of the Bank of Rome were caused, first of all, by the mad administration of Bernardo Tanlongo, the premises of this ruin must be related to the Great Depression, originated in 1873 by the collapse of the Vienna Stock Exchange, whose effects damaged for many years the main financial markets of the Old and New World.

We find useful to mention here these events because some causes originating the Great Depression were essentially very similar to those that generated the nowadays crisis and because its effects significantly influenced the fate of the Bank of Rome. After 1860, the population of the major capitals of Europe began to increase and, since 1870, there was an expansion of the urban construction sector, both private and public, particularly strong in Vienna, Paris and Berlin. Here this expansion was favoured also by the birth of financial institutions, specialized in providing real estate loans, granted easly and without adequate guarantees, in the wake of continuous price increases. In Italy, after the completion of its Unity, the banking system operating in the Old States was unprepared to feed the development of that industrialization process, which would lead many Italians to abandon the countryside to live in the shadow of factories.

At that time, the Italian economy was still focused on latifundium, where few persons had money and also the availability of capital was much lower than other European countries, like Britain, France and Germany, where the Industrial Revolution was already started. The necessary potential for the economic development was really scarce and concentrated in the hands of a small group of capitalists, operating above all in the north of Italy or sometimes in the Centre. We have to think that, in 1878, the shareholders of the 155 greater banks (who had a nominal capital exceeding 100.000 lire) were about 30.000, but only 4.580 subscribed shares for more than 10.000 lire and only about 450 of these were present in more than one company. A factor that gave vitality to the sleepy Italian banking system was the creation of institutes specialized in mobile credit. Following the example of the French Credit Mobiler, in 1863 were established in Italy the General Company of Mobile Credit and the Italian General Bank, with the function of deposits, loans and investments banks.

The prospect of a vast new market, not accommodated by the financial services of old banks, made possible the arrival of foreign capitals in Italy, favoring the expansion of credit institutions, such as the Bank of Discount and Sete of Turin and the Credit of Turin. While traditional banks were accustomed to the usual financing of the commercial development, the mobile credit institutes were more directed to the speculative aspect linked to the building expansion of cities, to the growing needs of industry and infrastructures and to financial transactions.The activities of these institutions were differed from those held by common banks as they collected the credit destinated to operations in anticipation and discount, following also the careful management of its customer patrimony. The common banks, instead, engaged the liquidity in activities of risk as the real estate speculation, the buying and selling stocks and shares, bonds and any other type of financial investment. This situation created the conditions that gave origin, in contemporary language, to the "economic bubbled", inflated by the immobilization of large amounts of capital used in building trade. This fact occurred because, even if the loans were granted on paper to builders throught immovables, credits were not quickly convertible into cash and when investors wanted to be reimbursed, there was not always the cash availability.

The financial crisis, caused by the collapse of the Vienna Stock Exchange in May 1873, had repercussions on all major European exchanges and also in Italy, causing the withdrawal of the most part of foreign capitals engaged in Italian companies, with heavy consequences for the new mobile credit institutes. In a few months, the banking system crisis spread also in United States where, on September the 18th, failed the Jay Cooke &Company, one of the major American banks, involved in the construction of big railway lines and of the building sector, in long-term investments not able to tackle reimbursement claims. The Jay Cook was an investment bank, as well as the Lemon Brothers: its collapse had a devastating impact on American and international financial system. When in Italy the first negative results of financial speculation were added to the strong lock-up of the building sector, mobile credit institutes adopted the system to support companies, to which they gave credit, buying their shares. The news about these interventions originated a lower confidence in financial market, causing the fall of shares on the stock exchange. After the lack of confidence spread from the stock exchange to investors, who began to claim the repayment of their deposits.

Due to a synergistic effect, the economic bubbled began to deflate and the construction companies - that built without capital operating only through credits - fell progressively into the paralysis and, in a short time, the excess of speculative urban constructions led up the collapse of the building sector. Rome, Naples and Turin were the most affected cities by the crash of the economic bubbled and, in a few months, were placed in liquidation the Mobile Credit and the General Company. The crash of the economic bubbled produced devastating prolonged consequences that led up the failure, of example, the Credit of Turin, the Bank of Discount and Sete and the Tiber Bank.

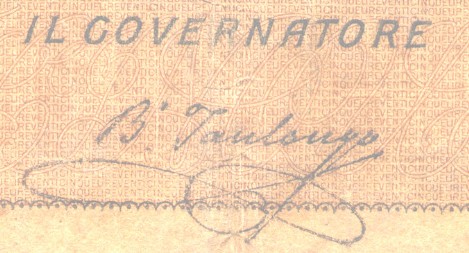

It's interesting to note how, after a few decades necessary to forget the memory of tragic events, new speculative economic bubbles have the tendency to reappear in the finance world: if we substitute the most recent scenarios of investment banks with the above mentioned mobile credit institutes, the script of the opera, titled "When the economic bubble bursts", presents alarming relevances. With the crash of the economic bubble, the Government tried to face the liquidity crisis creating the Italian Institute of Land Credit, which had to detect banks credits in favour of the building sector, issuing long-term amortizable land certificates. As the signing of certificates was disappointing, on several occasions the six issue Institutes were incited to rescue banks in crisis, obtaining in exchange not only an acquiescence to exceed the fixed limits for the notes issue, but also a systematic amnesty by Parliament. In this financial chaos, the Bank of Rome was able to survive until the death of Giuseppe Guerrini and, in the next General Assembly of shareholders on March the 29th 1881, Bernardo Tanlongo was appointed Governor for the biennium 1881-1882. Tanlongo was an adventurer who enjoyed the support of numerous politicians and who continued to hold the office of Governor until the assembly of December the 19th 1892, when he was re-elected for the biennium 1893-1894 too. The new Governor concentrate on himself any major management decision and he began to grante favors to many petitioners and politicians who knocked on his door. During his governorship, was issued the Royal Decree of August the 12th 1883, which provided the exceeding of the previous notes issue limit, provided that the surplus was covered by an equal amount in metal coins. Even this increase of money became soon insufficient to finance the vast system of corruption organized by Tanlongo, who thought to be so powerful that he could exercise on his own the right to seigniorage. The idea to issue banknotes on his own, and the subsequent falsification of balances, became the system through which he could compensate the lack of liquidity that involved at that time the credit institutes venturing into risk activities about financial, stock exchange and real estate speculation. To issue banknotes on his own, Tanlongo used a simple stratagem: duplicate the first issue created by the Bradbury & Wilkinson, commissioning a second one to another British company specialized in the production of paper money: the H.C. Sanders & Co. This second issue was realized with original printing plates and the same paper, as it could result identical to the previous one, whose had also the same serial numbers. The notes of this illegal and autonomous emission, were made expendable affixing illegally signatures, executed by Tanlongo with the help of his son and the Baron Lazzaroni, Chief Cashier of the Bank of Rome. The fraud was discovered during a series of ministerial inspections decided by Francesco Miceli, Minister of Agricultural, Industry and Commerce, but in reality desired by Francesco Crispi, Prime Minister in office, to acquiece Giovanni Nicotera, Minister of Interior of the previous government Antonio Starabba Marquis of Rudinì. The aim was to damage Girolamo Giusto, General Manager of the Bank of Naples, who had the misfortune to be unpopular with Nicotera. The same inspection was later extended to other five issue banks, to give it a formal guise of full legality. In 1889 there was an initial Ministerial inspection in six issues institutes. During the inspectiom many irregularities of the Bank of Rome emerged, including an excess of money of about 25 million in addition to 9.050.000 lire of illegal banknotes. Despite the clear denunciation exposed in the Alvisi-Biagini report, that the Minister Francesco Miceli presented to the Council of Ministers, the story was not reported, nor to the judiciary nor to the public opinion due to the safety net that the wily Tanlongo tried to weave. To ensure his coverage, Tanlongo continued to dispense money profusely to political leaders and to senior officials of the State, trying even to increase the Bank of Rome potential, which, in 1892, obtained the permission to open two branches. The first one was opened on February the 1st in Milan, and the second one on May the 1st in Venice. On January the 10th 1893 the Bank had 44 representatives in various provinces, where the exchange of banknotes was practiced. In 1893, after four years of cover-up, following the vehement denunciation pronounced in Parliament by the Member Napoleone Calajanni - who came in possession of the report Alvisi-Biagini - the Council of Ministers of the Giolitti Government was forced to discuss the matter and he was obliged to initiate a second Ministerial Inspection, from which emerged some irregularities, both for the two Banks of Naples and of Rome. In particular, about the latter was found the illegal issue of 41 million of lire plus an excess of circulation for 64.543.230 of lire. The publication of the results of this second inspection caused the explosion an enormous scandal involving journalists, deputies, ministers and the last three Presidents of the Council: Francesco Crispi, Antonio Staeabba and Giovanni Giolitti. In addition, the shadow of suspicion even darkened the image of the King. At the time of the scandal, many journalists indulged in the description of the Tanlongo biography, putting into circulation many different truths and legends. However, among so many stories, there is a certain fact: he was born poor and he employed every means to get rich. And he succeeded. The Corriere della Sera, which was certainly not a radical paper, on January the 20th 1893 described him as follows: "At twenty-nine years old, he evolved from a boy to a Frenchs spy in the Rome of Garibaldi. He was not a mercenary, but he rather understood that the whores bottoms - scanned in his youth for cardinals -, the letters and the hate simpers snatched in a face were the secret matter of money. So he was loyal to Jesuits and to the Lodges too, as the diversity of ideas or party seemed for him totally insignificant". Even if concise, this description shows the important aspects of an adventurer who realized how many power men, especially politicians, were so climbers as he was. To this end, it is curious to note how the name BERNARDO TANLONGO was an anagram in Italian language for GREAT WELL KNOWN THIEF. As they say in Italy, his destiny was in his name. But let's return to the young Tanlongo to guess what paths he followed to transform himself from an accomplice clergyman to a business man, to become then financier and finally governor of the Bank of Rome. Due to social contacts with high-ranking prelates - unscrupulous members of noble families and scoundrels of the neighbourhood - Bernardo Tanlongo worked in the twilight of the roman building cheats, first as nominee for the wealthy people who didn't want to appear and then exercising more and more the estate speculation on his own. Tanlongo was not only a capable financier: he had also an extraordinary ability in weaving and managing human relationships, which enabled him to build a network of relations with the Capitoline potentate and especially with political members. In 1893, when the scandal broke, Tanlongo didn't lose heart, as he emerged unscathed from the first survey, which found in reality irregularities in the Bank. In addition, for the services that Bernardo made to King Umberto (sending as nice gift two parcels of shares of the Tiberian Bank to his two lovers, the Duchess Litta and the Countess of Santafiora), Giolitti proposed his appointment as Senator of the Kingdom. And he was right in not losing heart, because he knew that the Savoy House and above all the important politicians - who took advantage of his generosity - would not allow the proper conduct of a criminal proceeding that, with him, would lead to condemnation many of the most eminent personalities of the nation. When the upright Prime Minister Francesco Crispi was determined to uncover the pot, his predecessor Giovanni Giolitti - who stole some documents from the senatorial investigation - carried out a diabolical strategy bringing back the stolen material to the Chember President, but among those documents there were casually also passionate letters written by the President's wife, Mrs. Lina Cispi, to her lover (the butler of the house), who gave them to Giolitti through lavish compensation. As Tanlongo expected, because of many of the most eminent personalities of the Kingdom were directly or indirectly involved in the affair, the trial celebration was simply a farce: this fact proves that, when the veil of politics covers the events, even the most sensational, any clear thing shines through that veil, and what transparency confusedly allows to see, it's dissimilar from the truth. The trial ended in 1894. In its sentence the court wrote that, because of the disappearance of necessary documents to prove the guilt of the accused, the criminal case was filed without issuing any conviction.Were also acquitted those defendants who, in the preliminary stage of examination, confessed their responsibilities in numerous crimes. Before the conclusion of the trial, with the Law of August the 10th 1893, the Bank of Rome was placed on liquidation and its notes lapsed on January the 31st 1898, prescription that in reality was brought forward to 1896.

Guido Grapanzano from: La Cartamoneta Italiana, Corpus Notarum Pecuniariarum Italiae, Volume II.

Jede Äußerung eines Individuums ist verschieden und basiert auf einer eigenen Sichtweise. Ein Großteil von intellektuellem Eigentum wird besonders im Internet zur freien Verfügung Aller gestellt. Dabei dürfen jedoch weder die moralischen noch die rechtlichen Pflichten außer Acht gelassen werden, die vorsehen, das Werk des Urhebers zu schützen und dieses nicht ohne Übereinstimmung des Verfassers zu übernehmen. Copyright Moruzzi Numismatica © 1999-2016